Paze

Creating the go-to payments brand for 150 million shoppers

The digital and mobile payments experience can be one of the more frustrating, friction-filled parts of our digital lives.

Both established and startup tech players are trying to solve this, flooding the market with solutions and leading to clutter and confusion.

Early Warning Services, a partnership of the nation’s largest banks and the creator of popular digital payments network Zelle, was uniquely positioned to cut through this noise with a new card-based, digital wallet solution.

To succeed, it needed a consumer-facing brand that brought the solution to life—one that signaled the stature of Early Warning’s membership organizations while flexing across their disparate identities and driving consumer adoption with digitally-native simplicity.

Here’s how we did it.

Big banks, big opportunity

Most successful brands in the payments space champion themes of security, ease and speed. The solution Early Warning offered would do the same, but with a clear differentiator: the existing trust and credibility consumers have with their bank. We knew Early Warning could leverage that institutional pedigree and security to become the go-to way for consumers to pay.

Our big brand idea evoked the reality that when it comes to their money, consumers want the assuredness and confidence of a known & trusted relationship. From that ethos, we created a comprehensive platform and manifesto that acted as a North Star for the rest of the brand.

Coining a name that pays off

With so many competitors out there, Early warning faced a high bar to stand out. Our biggest challenge was creating a name that united the diverse bank brands behind the offering, captured their prominence and power in the financial space, and popped in a highly crowded category.

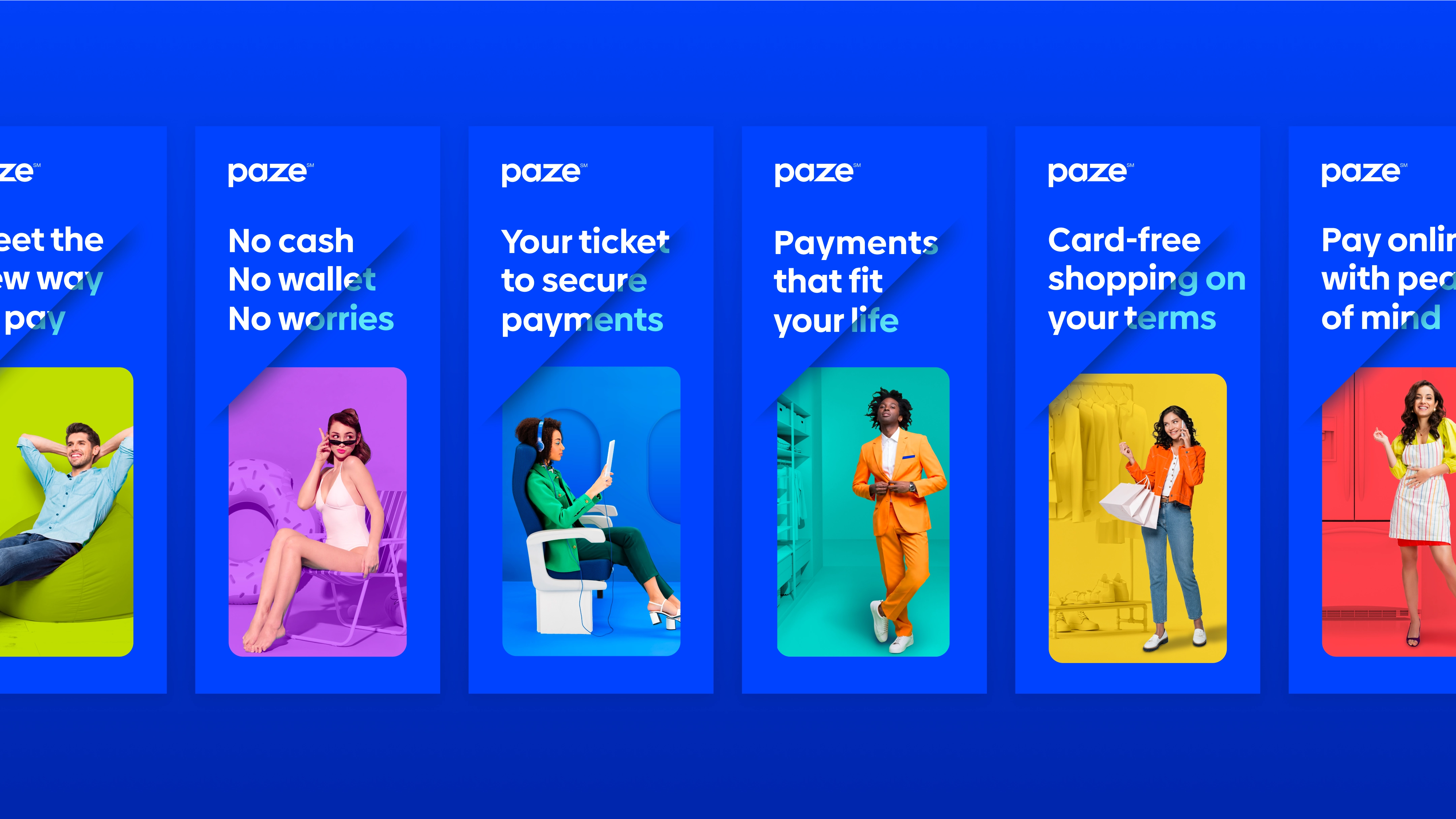

Paze is a highly intuitive name, pronounced exactly like “pays.” The stylized spelling of this single-syllable word is both modern and memorable, quickly communicating the brand’s intent and strategy.

A digital wallet that stands out

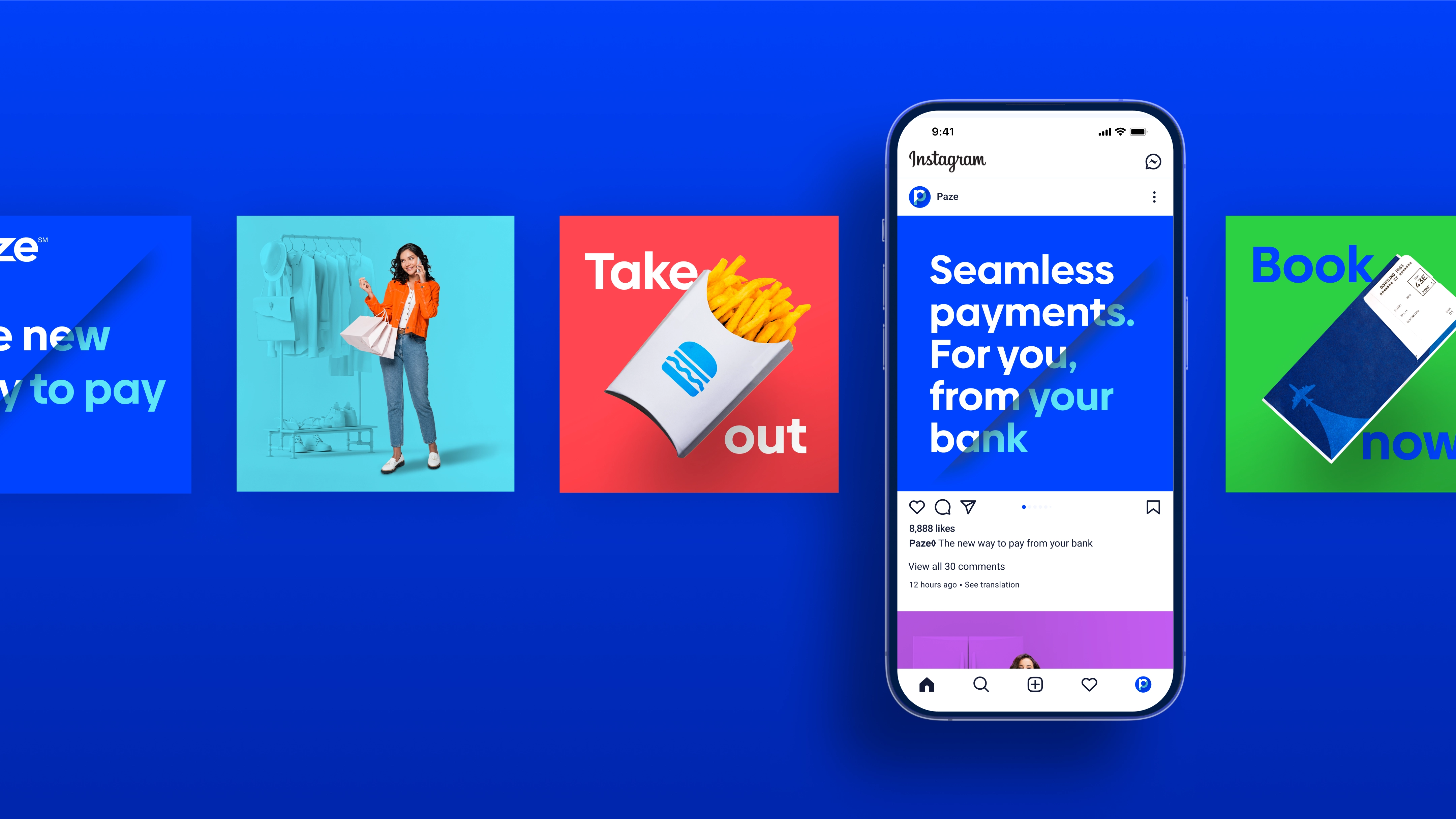

The Paze logo and visual identity had a clear objective—be eye-catching on a button in a mobile context to break through and drive brand recognition amidst a landscape of tech competitors.

The logo and surrounding visual system are anchored in the idea of the convenience of a wallet that fits your life, with the letter Z in the logo is reminiscent of a wallet’s card pocket. A simple and intuitive visual device that conveys a secure home for your bank cards. The metaphor is extended throughout the visual system, reinforcing personalization and convenience.

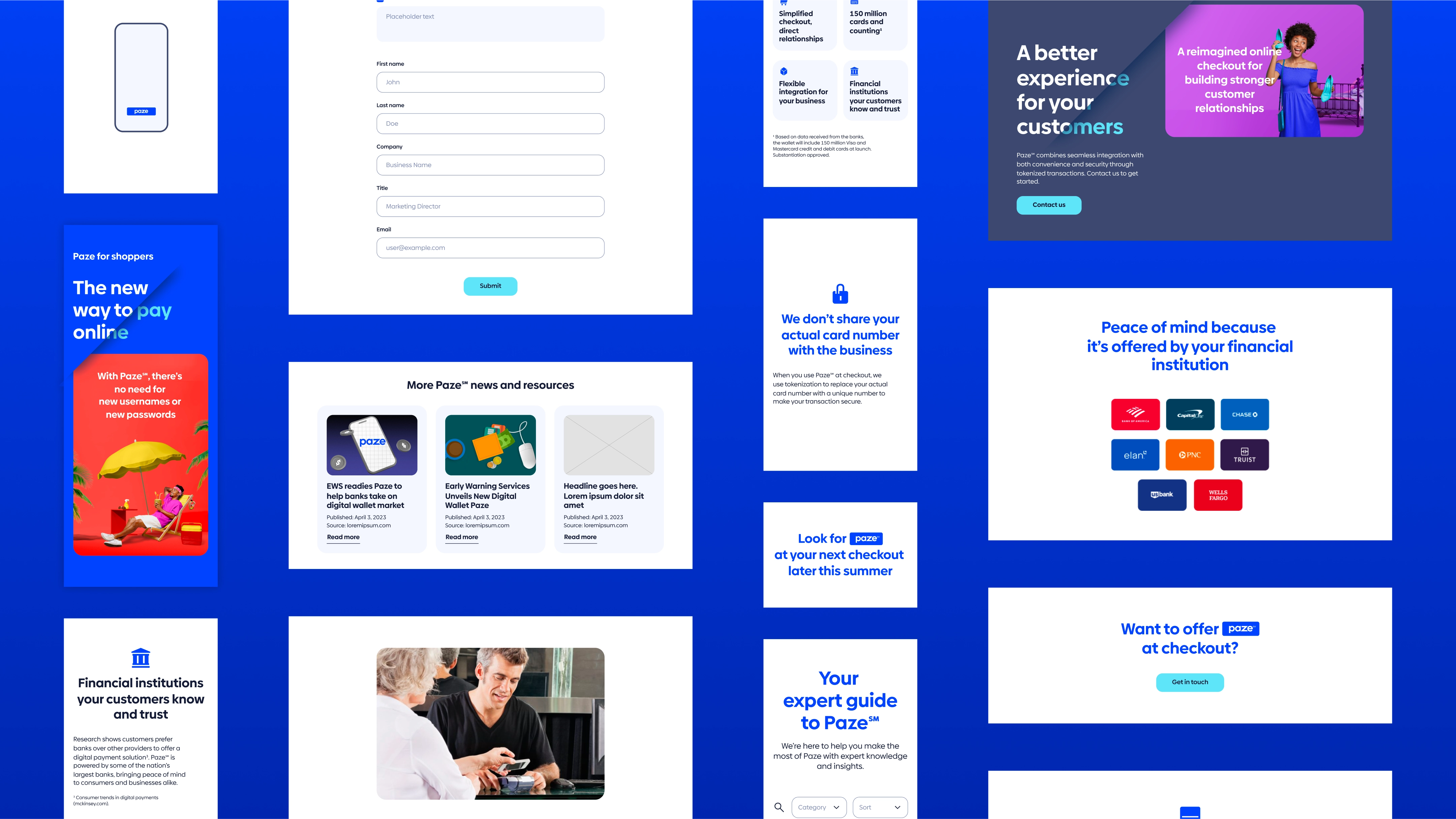

A versatile site to serve dual needs

The website was a critical element of the launch, introducing the brand and highlighting the product's value by emphasizing its differentiation from other digital wallets. The site architecture is built around tailored narratives for both consumer and merchant audiences. To accommodate the phased product rollout, the site's modular structure and content were developed to expand and evolve alongside the product. Serving as the first brand touchpoint, it aims to embody the product's value—delivering clear, concise messaging and a seamless flow, while using animation to reinforce key points and enhance memorability.

After launch in late 2023, Paze has continued to quickly sign merchant vendors across categories and provide a streamlined solution for consumers across the United States, with availablity for more than 150 million credit and debit cards. With a new brand designed to break through a cluttered space, Paze is poised to become a household name.